Your Tax Refund Can Help You Achieve Your Homebuying Goals

Have you been saving up to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve your goals by paying for some of these expenses. SmartAsset estimates the average American will receive a $1,798 tax refund this year. The map below provides a more detailed estimate by state: According to Freddie Mac, there are multiple ways your refund check can help you as a homebuyer. If you’re getting a refund this year and thinking about buying a home, here are a few tips to keep: Saving for a down payment – One of the largest barriers to homeownership is saving for a down payment. You could reach your savings goal more quickly than expected by using your tax refund to help with your down payment. Paying for closing costs – You have to pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before you can officially take ownership of your home. You could direct your tax refund toward these closing costs. Lowering your interest rate – Your lender might give you the option to buy down your mortgage interest rate during the homebuying process. That means, you could pay upfront to have a lower interest rate on your fixed-rate mortgage. The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey. Bottom Line Your tax refund can help you reach your goals of homeownership. Let’s connect to discuss how you can start your journey today.

Read MoreWant To Sell Your House This Spring? Price It Right.

Over the last year, the housing market’s gone through significant change. While it’s still a sellers’ market, homes that are priced right are selling, and they get the most attention from buyers right now. If you’re thinking of selling your house this spring, it’s important to lean on your expert real estate advisor when it comes to setting a list price. As Realtor.com explains: “Move-in-ready homes with curb appeal and in desirable areas—and that are priced to sell—are especially likely to move quickly this spring.” In today’s market, how you price your house will not only make a big difference to your bottom line, but to how quickly your house will sell. Why Pricing Your House Right Matters Your asking price sends a message to potential buyers, especially today. If it’s priced too low, you may leave money on the table or discourage buyers who may see a lower-than-expected price tag and wonder if that means something is wrong with the home. If it’s priced too high, you run the risk of deterring buyers. When that happens, you may have to lower the price to drive interest when your house sits on the market for a while. But be aware that a price drop can be seen as a red flag by some buyers who will wonder what it means about the home. To avoid either headache, price it right from the start. A real estate professional knows how to determine the ideal asking price. They balance the value of homes in your neighborhood, current market trends, buyer demand, the condition of your house, and more to find the right price. This helps lead to stronger offers and a greater likelihood your house will sell quickly. The visual below helps summarize the impact your asking price can have: Bottom Line Homes priced at the current market value are selling faster and at a better price right now. To make sure you price your house appropriately, maximize your sales potential, and minimize your hassles, let’s connect today.

Read MoreThe Big Advantage if You Sell This Spring

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low. HousingWire shares: “. . . the big question is whether we are finally starting to see the seasonal spring increase in inventory. The answer is no, because active listings fell to a new low last week for 2023 . . .” The National Association of Realtors (NAR) confirms today’s housing inventory is low by looking at the months’ supply of homes on the market. In a balanced market, about a six-month supply is needed. Anything lower is a sellers’ market. And today, the number is much lower: “Total housing inventory registered at the end of February was 980,000 units, identical to January and up 15.3% from one year ago (850,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, down 10.3% from January but up from 1.7 months in February 2022.” Why Does Low Inventory Make It a Good Time To Sell? The less inventory there is on the market when you sell, the less competition you’re likely to face from other sellers. That means your house will get more attention from the buyers looking for a home this spring. And since there are significantly more buyers in the market than there are homes for sale, you could even receive more than one offer on your house. Multiple offers are on the rise again (see graph below): If you get more than one offer on your house, it becomes a bidding war between buyers – and that means you have greater leverage to sell on your terms. But if you want to maximize the opportunity for a bidding war to spark, be sure to lean on your expert real estate advisor. While we’re still in a strong sellers’ market, it isn’t the frenzy we saw a couple of years ago, and today’s buyers are focused on the houses with the greatest appeal. Clare Trapasso, Executive News Editor at Realtor.com, explains: "Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country. So, this spring, it's especially important for sellers to make their homes as attractive as possible to appeal to as many buyers as possible.” Bottom Line If you’ve been waiting for the right time to sell your house, low inventory this spring sets you up with a big advantage. Let’s connect today to make sure your house is ready to sell.

Read MoreThe 5 Best Assisted Living Facilities in Rochester, MN for 2023

Have you thought what to consider about assisted living in Rochester, MN? What about the benefits and drawbacks that come with assisted living? Have you ever wondered what the laws and regulatoins of assisted living is in Minnesota? Caring.com is a great resource for detailed information about the 5 best Assisted Living Facilities in Rochester, and what you should know about going into an assisted living facility. In this article you will find answers to a wide scope of knowledge. Belows is a quick overview of what you will find in their article. We recommend reading the story directly from their site for the full experience. Read Caring.com The 5 Best Assisted Living Facilities in Rochester, MN Rochester, Minnesota, is best known for being the home of the Mayo Clinic, an elite health care facility at the leading edge of research and treatment. However, Minnesota’s third-largest city also has plenty of fun options for tourists and residents alike, including lakes and rivers for boating and beautiful scenic drives to enjoy the countryside. Nearly 15% of the 119,000 residents are 65 years and older, and many of these seniors may be considering their long-term care options. Assisted living facilities are a popular choice for seniors who have trouble completing the tasks of daily living. They offer a group setting that provides meals and light housekeeping, plus personal care attendants on hand 24-7 to help with grooming, mobility assistance, escorts to meals or events and discreet help in the toilet or shower. The average monthly cost for assisted living in Rochester is $3,105, which may be accessible for many seniors with limited means. The top 5 Assisted Living Facilities in Rochester, MN 1. River Bend Senior Living 2. Meadow Lakes Senior Living- 3. Shorewood Senior Campus 4. Charter House Mayo Clinic Retirement Living 5. Madonna Meadows of Rochester Caring.com curated a detailed article with data driven information to educate those seeking or looking into assisted living. We broke down Caring.com's main focus topics and made them into a list below. We recommend reading the story directly from their site as it is packed full with procudures, policies, laws, payments and financial assistance, what to expect, costs, and more. COVID-19 Rules for Assisted Living in the Rochester What to Consider About Assisted Living in Rochester Benefits and Drawbacks of Assisted Living in Rochester Paying for Assisted Living in Rochester The Cost of Assisted Living in Nearby Cities The Cost of Other Types of Senior Care Financial Assistance for Assisted Living in Rochester Ways to Pay for Assisted Living Free Assisted Living Resources in Rochester Assisted Living Laws and Regulations in Rochester Read the full article on the Top 5 Assisted Living Facilities in Rochester, MN here.

Read MoreThe Role of Access in Selling Your House

Once you’ve made the decision to sell your house and have hired a real estate agent to help, they’ll ask how much access to your home you want to give potential buyers. Your answer matters more now than it did in recent years. Here’s why. At the height of the buying frenzy seen during the pandemic, there was a rise in the number of homebuyers who put offers on houses sight unseen. That happened for three reasons: Extremely low housing inventory A lot of competition from other buyers wanting to take advantage of historically low mortgage rates And general wariness of in-person home tours during a pandemic Today, the market’s changing, and buyers can usually be more selective and take more time to explore their options. So, in order to show your house and sell it efficiently, you’ll want to provide buyers with as much access as you can. Before letting your agent know what works for you, consider these five levels of access you can provide. They’re ordered from most convenient for a buyer to least convenient. Remember, your agent will be better able to sell your house if you provide as much access to buyers as possible. Lockbox on the Door – This allows buyers the ability to see the home as soon as they are aware of the listing or at their convenience. Providing a Key to the Home – This would require an agent to stop by an office to pick up the key, which is still pretty convenient for a buyer. Open Access with a Phone Call – This means you allow a showing with just a phone call’s notice. By Appointment Only – For example, you might want your agent to set up a showing at a particular time and give you advance notice. That way you can prepare the house and be sure you have somewhere else you can go in the meantime. Limited Access – This might mean you’re only willing to have your house available on certain days or at certain times of day. In general, this is the most difficult and least flexible way to show your house to potential buyers. As today’s housing market changes, be sure to work with your local agent to give buyers as much access as you can to your house when you sell.

Read MoreEscape to Your Own Private Oasis: A Gorgeous Home on 10+ Acres

If you're looking for a serene and spacious retreat not too far from the city, this stunning property may be the one for you. Located at 575 White Birch CT NW in Oronoco Township, Minnesota, this home boasts over 10 acres of land that offer both privacy and natural beauty. With a listing price of $700,000, this property is a rare gem that combines comfort, convenience, and countryside charm. Upon arriving at the property, you'll be struck by the peaceful setting that surrounds the house. The 5-bedroom, 3-bathroom home is nestled among tall trees and greenery, creating a sense of seclusion that's hard to find in the suburbs. The property also backs up to the South Fork Zumbro River, which means you'll have access to tranquil views and water activities whenever you want. Inside the house, you'll be greeted by a spacious and inviting interior that's perfect for both relaxing and entertaining. The bedrooms are generously sized and offer plenty of natural light and closet space. The kitchen is a chef's dream, with ample counter space, modern appliances, and a pantry. The open concept design of the main floor allows for seamless flow from the kitchen to the living room and dining area, which also offer stunning views of the outdoors. One of the most exciting features of this home is the unfinished walkout basement, which opens up to the backyard and can be easily transformed into a variety of spaces. Whether you want to create a home gym, a media room, or a guest suite, you'll have plenty of room to customize the space to your liking. The basement also has a bathroom rough-in and a wet bar rough-in, which means you can add even more functionality and value to the home. Another major advantage of this property is its proximity to Rochester, which is only 20 minutes away. This means you can enjoy the peace and quiet of your own private oasis while still being able to access the amenities and opportunities of the city. Whether you're commuting to work, shopping, or dining out, you'll have everything you need within a short drive. If you're ready to escape to your own private oasis, don't hesitate to schedule a showing of this beautiful home today. With its unbeatable location, impressive features, and stunning views, it's sure to capture your heart and imagination.

Read MoreLeverage Your Equity When You Sell Your House

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this: “Home equity is the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.” Majority of Americans Have a Large Amount of Equity If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of equity right now (see graph below): And having such large amounts of equity is a benefit to homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains: “Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008.” Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home. Bottom Line By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect today so you can find out how much home equity you have and start planning your next move.

Read MoreIs It Really Better To Rent Than To Own a Home Right Now?

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on. A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio. But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains: “One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.” The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below): So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides. Bottom Line If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

Read More4 Tips for Making Your Best Offer on a Home

Are you planning to buy a home this spring? Though things are more balanced than they were at the height of the pandemic, it’s still a sellers’ market. So, when you find the home you want to buy, remember these four tips to make your best offer. 1.Lean on a Real Estate Professional Rely on an agent who can support your goals. As Bankrate notes: “. . . select the best real estate agent for your needs. They will be a critical part of your home buying process.” Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for in an offer. It may seem simple, but catering to what a seller needs can help your offer stand out. 2.Know Your Budget Understanding your budget is especially important right now. As Sandy Higgins, Senior Wealth Advisor at Capstone Financial Advisors, puts it: “Understand your current budget … what are your expenses, how’s your spending, would you need to make changes?” The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. It helps you be more financially confident, and it shows sellers you’re serious. That can give you a competitive edge. 3.Think Through Everything Before Making an Offer Today’s market isn’t moving at the record pace it did during the pandemic. That means you may have a bit more time to think before you need to make an offer. According to Danielle Hale, Chief Economist at realtor.com: “In general, you likely have more time to make an offer, although that’s certainly not a guarantee. If you’re on the fence about a home or its asking price doesn’t quite fit your budget, you might want to keep an eye on it, and if it doesn’t sell right away, you may have some room to negotiate with the seller.” While it’s still important to stay on top of the market and be prepared to move quickly, there can be more flexibility today. Lean on the advice of your agent as you explore the options in your market. 4. Work with Your Advisor To Negotiate During the pandemic, some buyers skipped home inspections or didn’t ask for concessions from the seller in order to submit the winning bid on a home. Fortunately, today’s market is different, and you may have more negotiating power than before. When putting together an offer, your trusted real estate advisor will help you think through what levers to pull.

Read MoreAn Expert Makes All the Difference When You Sell Your House

If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale. 1. They’re Experts on Market Trends With today’s housing market defined by change, it’s critical to work with someone who knows the latest information and how it impacts your goals. An expert real estate advisor knows about national trends and your local area too. More importantly, they’ll give insight to what all of this means for you, so they’ll be able to help you make a decision based on trustworthy, data-bound information. 2. A Local Professional Knows How To Set the Right Price for Your Home Home price appreciation has moderated this year. If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. Pricing your house too high can deter buyers or cause your house to sit on the market for longer. Real estate professionals look at a variety of factors, like the condition of your home and any upgrades you’ve made, with an unbiased eye. They compare your house to recently sold homes in your area to find the best price for today’s market so your house sells quickly. 3. A Real Estate Advisor Helps Maximize Your Pool of Buyers Since buyer demand has cooled this year, you’ll want to do what you can to help bring in more buyers. Real estate professionals have a wide range of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS), to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides: “You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.” Without access to your agent’s tools and marketing expertise, your buyer pool – and your home’s selling potential – is limited. 4. A Real Estate Expert Will Read – and Understand – the Fine Print Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) puts it like this: “There’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.” 5. A Local Professional Is a Skilled Negotiator In today’s market, buyers are regaining some negotiation power. If you sell without an expert, you’ll be responsible for any back-and-forth. That means you’ll have to coordinate with: The buyer, who wants the best deal possible The buyer’s agent, who will use their expertise to advocate for the buyer The inspection company, which works for the buyer and will almost always find concerns with the house The appraiser, who assesses the property’s value to protect the lender Instead of going toe-to-toe with these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion. Bottom Line Don’t go at it alone. If you’re planning to sell your house this spring, let’s connect so you have an expert by your side to guide you in today’s market.

Read MoreA Smaller Home Could Be Your Best Option

Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says: “As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes.” Lautz lists two options: move into a multigenerational home with loved ones, or stay in your current house. Multigenerational living is rising in popularity, but it isn’t an option for everyone. And staying put may fit fewer and fewer of your needs. There’s a third option though, and for some, it’s the best one: downsizing. When you sell your house and purchase a smaller one, it’s known as downsizing. Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location. In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares: “Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.” Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference. A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home. So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. Your local real estate advisor is the best resource to help you understand how much equity you may have in your current home and what options it can provide for your next move. Bottom Line If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Let’s connect so you can understand your options and explore your downsizing opportunities.

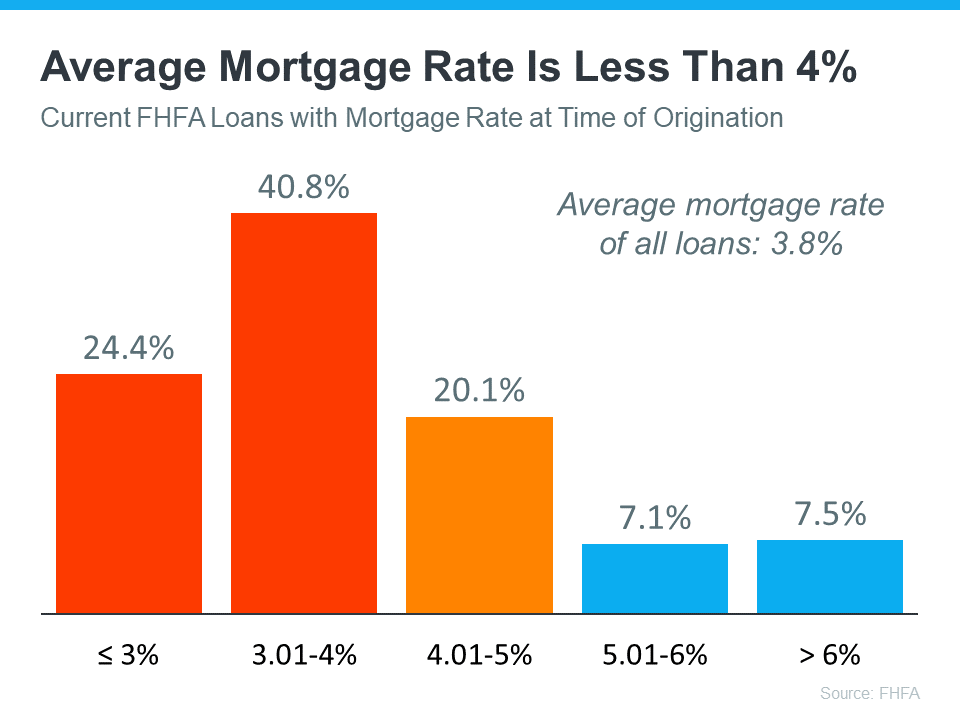

Read MoreThe Two Big Issues the Housing Market’s Facing Right Now

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply: “Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.” Let’s break down these two big issues in today’s housing market. Rate-Locked Homeowners According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below): But today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked. When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens. The Fear of Not Finding Something To Buy The other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options. That includes newly built homes, especially right now when builders are offering concessions like mortgage rate buydowns. What Does This Mean for You? These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market is a sweet spot that can work to your advantage. Be sure to work with a local real estate professional to explore the options you have right now, which could include leveraging your current home equity. According to ATTOM: “. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.” This could make a major difference when you move. Work with a local real estate expert to learn how putting your equity to work can keep the cost of your next home down. Bottom Line Rate-locked homeowners and the fear of not finding something to buy are keeping housing inventory low across the country. But as mortgage rates start to come down this year and homeowners explore all their options, we should expect more homes to come to the market.

Read MoreWhy It’s Easy To Fall in Love with Homeownership

No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours. Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them. As a result, the emotional benefits our homes provide have become even more important to us. As the most recent State of the American Homeowner from Unison puts it: “. . . one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.” The same study from Unison notes: 91% of homeowners say they feel secure, stable, or successful owning a home 64% of American homeowners say living through a pandemic has made their home more important to them than ever It’s no surprise this study also reveals that homeowners now love their homes even more as our attachments to them have grown: The National Association of Realtors (NAR) also explains: “In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.” In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully. Bottom Line Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with.

Read MoreWondering What’s Going on with Home Prices?

The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices. Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains: “U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.” Month-over-month home price changes can be seen in the chart below. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices aren’t in a freefall. What Does This Mean for You? If you currently own your house, you may be concerned about even the smallest decline in prices. But keep in mind how much home values grew over the last few years. Compared to that growth, any declines we’re seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares: “. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.” It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the home prices in your area if you’re planning to make a move this spring. Bottom Line To understand what’s going on with home prices in our market and how they could impact your goals, let’s connect today.

Read MoreShould You Rent Your House or Sell It?

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. According to a Harris Poll survey, 28% of homeowners have considered using a rental service to temporarily rent out their home for additional income. Owning a short-term rental can be a tempting idea, but you may find the reality of being responsible for one difficult to take on. Here are some of the challenges you could face if you rent out your house instead of selling it. A Short-Term Rental Comes with Responsibilities Successfully owning and renting a house takes work. Think through your ability to make that commitment, especially if you plan to use a platform that advertises your rental listing. Most of them have specific requirements hosts have to meet, and it takes a lot of work. A recent article from Bankrate explains: “Managing a rental property can be time-consuming and challenging. Are you handy and able to make some repairs yourself? If not, do you have a network of affordable contractors you can reach out to in a pinch? Consider whether you want to take on the added responsibility of being a landlord, which means screening tenants and fielding issues, among other responsibilities, or paying for a third party to take care of things instead.” Not only is there the upfront time and cost of owning a short-term rental, but there are also risks that could come up for you down the road. Investopedia warns: “Risks of hosting include renting your place to rude guests, theft or damaged property, complaints from neighbors, and potential regulatory violations depending on your location.” There’s a lot to consider before taking the leap and converting your house into a short-term rental. If you aren’t ready for the work it takes, it could be wiser to sell instead. Your House May Not Be Ideal for Your Rental Goals Not every house ends up being a profitable short-term rental either. One of the biggest factors is where your home is located. The less likely your neighborhood is to be a travel destination, the fewer requests you should expect from potential renters—and that impacts your bottom line. An article from the National Association of Realtors (NAR) advises: “When it comes to the viability of profitable STRs . . . consider factors like location, amenities, and whether the property is appealing. Most people seek STRs in locations where they vacation, so proximity to attractions is important. Likewise, the property should cater to a variety of travelers.” It’s smart to do your homework and learn how much rentals in your area go for, how much business they get throughout the year, and how this compares to your goals. Bottom Line Converting your home into a short-term rental isn’t a decision you should make without doing your research. To decide if selling your house is a better alternative, let’s connect today.

Read MoreWhat You Should Know About Closing Costs

Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for. What Are Closing Costs? People are sometimes surprised by closing costs because they don’t know what they are. According to Bankrate: “Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .” In other words, your closing costs are a collection of fees and payments involved with your transaction. According to Freddie Mac, while they can vary by location and situation, closing costs typically include: Government recording costs Appraisal fees Credit report fees Lender origination fees Title services Tax service fees Survey fees Attorney fees Underwriting Fees How Much Will You Need To Budget for Closing Costs? Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too. According to the Freddie Mac article mentioned above, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs. Let’s say you find a home you want to purchase for the median price of $366,900. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,500 and $18,500. Keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower. What’s the Best Way To Make Sure You’re Prepared at Closing Time? Freddie Mac provides great advice for homebuyers, saying: “As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.” Work with a team of trusted real estate professionals to understand exactly how much you’ll need to budget for closing costs. An agent can help connect you with a lender, and together your expert team can answer any questions you might have. Bottom Line It’s important to plan for the fees and payments you’ll be responsible for at closing. Let’s connect so I can help you feel confident throughout the process.

Read MoreYou May Have More Negotiation Power When You Buy a Home Today

Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less competition from other buyers. And with less competition comes more opportunity. Here are two trends that may be the news you need to reenter the market. 1. The Return of Contingencies Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or the inspection, in hopes of gaining an advantage in a bidding war. But now, things are different. The latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving their home inspection or appraisal is down. And a recent article from realtor.com points out more sellers are accepting contingencies: “A year ago, sellers were calling all the shots and buyers were launching legendary bidding wars, waiving contingencies, and paying for homes in cash. But now, the shoe is on the other foot, and 92% of home sellers are accepting some buyer-friendly terms (frequently related to home inspections, financing, or appraisals), . . .” This doesn’t mean we’re in a buyers’ market now, but it does mean you have a bit more leverage when it comes time to negotiate with a seller. The days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be coming to a close. 2. Sellers Are More Willing To Help with Closing Costs Before the pandemic, it was a common negotiation tactic for sellers to cover some of the buyer’s closing costs to sweeten the deal. This didn’t happen as much during the peak buyer frenzy over the past two years. Today, data suggests this is making a comeback. A realtor.com survey shows 32% of sellers paid some or all of their buyer’s closing costs. This may be a negotiation tool you’ll see as you go to purchase a home. Just keep in mind, limits on closing cost credits are set by your lender and can vary by state and loan type. Work closely with your loan advisor to understand how much a seller can contribute to closing costs in your area. Bottom Line Despite the extremely competitive housing market of the past several years, today’s data suggests negotiations are starting to come back to the table. To find out how the market is shifting in our area, let’s connect today.

Read MoreThink Twice Before Waiting for 3% Mortgage Rates

Last year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a hit to their purchasing power as a result, and some decided to press pause on their plans. Today, the rate of inflation is starting to drop. And as a result, mortgage rates have dipped below last year’s peak. Sam Khater, Chief Economist at Freddie Mac, shares: “While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023.” That’s potentially great news if you’re a buyer aiming to jump back into the housing market. Any drop in mortgage rates helps boost your purchasing power by bringing down your expected monthly mortgage payment. This means the lower mortgage rates experts forcast this year could be just what you need to reignite your homebuying goals. While this opens up a window of opportunity for you, remember: you shouldn’t expect rates to drop back down to record lows like we saw in 2021. Experts agree that’s not the range buyers should bank on. Greg McBride, Chief Financial Analyst at Bankrate, explains: “I think we could be surprised at how much mortgage rates pull back this year. But we’re not going back to 3 percent anytime soon, because inflation is not going back to 2 percent anytime soon.” It’s important to have a realistic vision for what you can expect this year, and that’s where the advice of expert real estate advisors is critical. You may be surprised by the impact even a mild drop in mortgage rates has on your budget. If you’re ready to buy a home now, today’s market presents the opportunity to get a more affordable mortgage rate, find your dream home, and face less competition from other buyers. Bottom Line The recent pullback in mortgage rates is great news – but if you’re ready to buy now, holding out for 3% is a mistake. Work with a local lender to learn how today’s rates impact your goals, and let’s connect to explore your options in our area.

Read MorePlanning To Sell Your House? It’s Critical To Hire a Pro.

With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with a trusted housing market expert. Here are five reasons working with a professional can ensure you’ll get the most out of your sale. 1. A Real Estate Advisor Is an Expert on Market Trends Leslie Rouda Smith, 2022 President of the National Association of Realtors (NAR), explains: "During challenging and changing market conditions, one thing that's calming and constant is the assurance that comes from a Realtor® being in your corner through every step of the home transaction. Consumers can rely on Realtors®' unmatched work ethic, trusted guidance and objectivity to help manage the complexities associated with the home buying and selling process.” An expert real estate advisor has the latest information about national trends and your local area too. More importantly, they’ll know what all of this means for you so they’ll be able to help you make a decision based on trustworthy, data-bound information. 2. A Local Professional Knows How To Set the Right Price for Your House Home price appreciation has moderated this year. If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. If you do, you run the risk of deterring buyers or seeing your house sit on the market for longer. Real estate professionals provide an unbiased eye when they help you determine a price for your house. They’ll use a variety of factors, like the condition of your home and any upgrades you’ve made, and compare your house to recently sold homes in your area to find the best price for today’s market. These steps are key to making sure it’s set to move as quickly as possible. 3. A Real Estate Advisor Helps Maximize Your Pool of Buyers Since buyer demand has cooled this year, you'll want to do what you can to help bring in more buyers. Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides: “You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.” Without access to the tools and your agent’s marketing expertise, your buyer pool – and your home’s selling potential – is limited. 4. A Real Estate Expert Will Read – and Understand – the Fine Print Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. NAR explains it like this: “Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . . Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.” A real estate professional knows exactly what all the fine print means and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own. 5. A Trusted Advisor Is a Skilled Negotiator In today’s market, buyers are also regaining some negotiation power as bidding wars ease. If you sell without a professional, you’ll also be responsible for any back-and-forth. That means you’ll have to coordinate with: The buyer, who wants the best deal possible The buyer’s agent, who will use their expertise to advocate for the buyer The inspection company, which works for the buyer and will almost always find concerns with the house The appraiser, who assesses the property’s value to protect the lender Instead of going toe-to-toe with all the above parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion. Bottom Line Don’t go at it alone. If you’re planning to sell your house this winter, let’s connect so you have an expert by your side to guide you in today’s market.

Read MoreWant To Sell Your House? Price It Right.

Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations accordingly. As realtor.com explains: “. . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible.” In a more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell. And the reality is, homes priced right are still selling in today’s market. Why Pricing Your House Appropriately Matters Especially today, your asking price sends a message to potential buyers. If it’s priced too low, you may leave money on the table or discourage buyers who may see a lower-than-expected price tag and wonder if that means something is wrong with the home. If it’s priced too high, you run the risk of deterring buyers. When that happens, you may have to lower the price to try to reignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag by some buyers who will wonder what that means about the home. To avoid either headache, price it right from the start. A real estate professional knows how to determine that ideal asking price. They balance the value of homes in your neighborhood, current market trends, buyer demand, the condition of your house, and more to find the right price. This helps lead to stronger offers and a greater likelihood your house will sell quickly. The visual below helps summarize the impact your asking price can have: Bottom Line Homes that are priced at current market value are still selling. To make sure you price your house appropriately, maximize your sales potential, and minimize your hassle, let’s connect.

Read More

Categories

Recent Posts